S&P: Fintech Funding Rebounds but Faces Geopolitical Hurdles

S&P Global Market Intelligence data shows 46% rise in Q1 investment values despite fewer deals, while market participants warn of tariff impact on growth

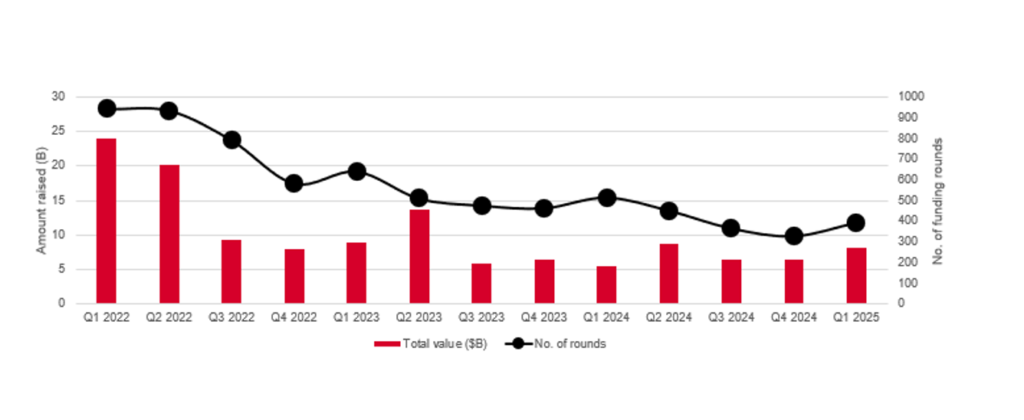

Global fintech investment demonstrated signs of recovery in the first quarter of 2025, according to research from S&P Global Market Intelligence, a provider of financial data and analytics.

Fintech startups secured US$8.07bn across 393 funding rounds globally during Q1 2025, representing a 46% increase in capital raised compared to the same period last year, while deal count fell by 24%.

The report highlights contrasting regional performance, with North American and European markets showing resilience whilst Asia-Pacific experienced a sharp downturn.

Regional disparities emerge

North American fintech firms attracted US$4.7bn in the first quarter, a substantial increase from US$1.9bn in Q1 2024, despite deal count declining from 214 to 155. This suggests investors are making larger bets on fewer companies in the region.

The Europe, Middle East and Africa (EMEA) region maintained momentum with funding rising from US$1.4bn to US$2.1bn, while rounds decreased marginally from 148 to 134.

Asia-Pacific markets faced challenges with capital allocation dropping from US$1.7bn to US$600m and activity declining from 119 to 80 rounds, indicating potential investor caution in the region.

Latin American fintech companies secured modest gains with funding increasing from US$400m to US$700m, though the number of rounds contracted from 34 to 24.

Segment performance varies

The payments sector, which includes companies processing financial transactions between consumers and merchants, emerged as a beneficiary of increased investor confidence.

Funding in this segment more than doubled from US$1.2bn in Q1 2024 to US$2.5bn in Q1 2025, while the number of deals decreased slightly from 123 to 114.

Banking technology, which encompasses solutions for core banking systems and financial institution infrastructure, experienced a contraction with total investments declining from US$1.3bn to US$1.2bn and rounds falling from 67 to 41.

The divergence between segments reflects shifting investor priorities in an uncertain economic environment, with capital flowing towards established payment infrastructures rather than novel banking technologies.